Is Gold In A Bubble?

How To Profit Whether It's

"Yes" or "No"

You can't trust Wall Street or the media to tell you when gold's run is over ...

But I've developed a proprietary "buy and hold" Gold Trigger that's performed remarkably well at foreseeing major gold trends.

Are you ready to ride the very lucrative gold wave AND the other key investment trends in this New Age of Desperation?

From the Desk of Graham Summers

Dear Gold Hunter,

Everyone's starting to talk about gold these days. Many observers are openly wondering if it's in a bubble and whether they'd be fools to buy now.

Are they correct? Or is gold still cheap today?

It depends on whether you're interested in gold as an investment. Or as money. Or maybe even both. Personally I'm a gold bull and I think gold will be the currency of the future.

|

Insane Monetary Base Expansion: The Fed is blowing out the money supply faster and faster. There's no officially-recognized inflation (yet) but you and I know it's coming. Like a ticking bomb, inflation will detonate one day soon and non-gold holders are in for a world of pain. |

|

Ballooning Government Debt: The expanding debt is already at levels which are essentially unrepayable, and yet more is added every time the government and the Fed open their mouths or put pen to paper. Default or inflate? Every day the powers that be have even more incentive to do away what they owe. |

|

Foreign Investors Don't Get To Vote: Foreign debt investors can't vote our politicians out of office, can they? All they can do is dump their Treasuries and other dollar-denominated IOUs once they're the suckers left holding the inflationary bag. This makes inflation even more potent as those sales will push down the dollar's foreign exchange value (and raise import costs). |

|

Many Voting Citizens Are Easy To Deceive: Conveniently, those same "nasty" foreigners can be blamed for the domestic woes wreaked by our home-grown inflation. Heard any China-bashing lately? It will rise to a fever pitch even as the government's (and the Fed's) self-inflicted misery hits us hard. |

But that doesn't mean I won't also trade gold to avoid whiplashes. Here's why...

|

Volatility, The Wave Of The Future: But nothing will happen as easy as 1-2-3. The violent gyrations we'll soon be seeing will have no real precedent. And that's why it makes sense to trade gold from time to time, not just hold it. Profiteering works both ways! |

|

The Masses Will Be Late To The Party: At some point, Joe and Jane Public will wake up to gold's enormous profit potential and drive the yellow metal into the stratosphere. That market hysteria will be enormously profitable for you and I as gold holders. But eventually all good things will come to an end. Will you know when the inevitable bubble's formed and ready to pop? |

So I hope you can see that with the right tools, it makes perfect sense to play the major peaks and valleys in gold. We're poised to ride the trend until it ends, and we can get out in a timely fashion once a genuine bubble's formed.

Did You Catch Both Legs

Of The Gold Bull

And Avoid The Crash Of 2008?

If not, I have just the solution for you. I've developed a proprietary "buy and hold" Gold Trigger that's performed remarkably well at foreseeing major gold trends.

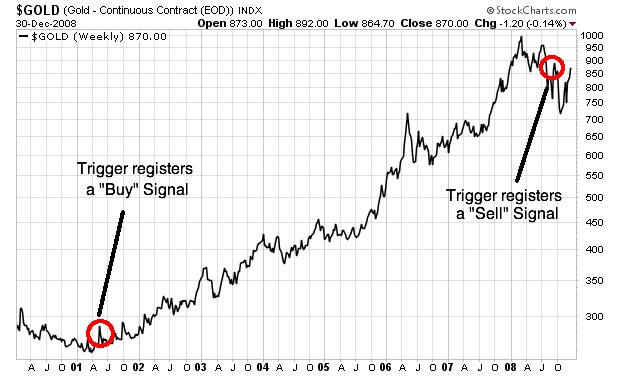

It's not for short-term trading, though. In the last 10 years, this trigger has only fired three times: two "BUYs" and one "SELL" signal.

The first "Buy" signal registered in May 2001 when Gold was trading around $250 per ounce. If you'd bought then and waited until this trigger registered a "Sell" signal you would have ridden Gold all the up way to $875 an ounce in July 2008.

That's a gain of 227%.

And that "Sell" signal would have gotten you out a full two months before the Autumn Crash took Gold down to $718. So you would have sat quite comfortably during the 2008 debacle while everyone else panicked.

You wouldn't have had to wait long to get back in, either.

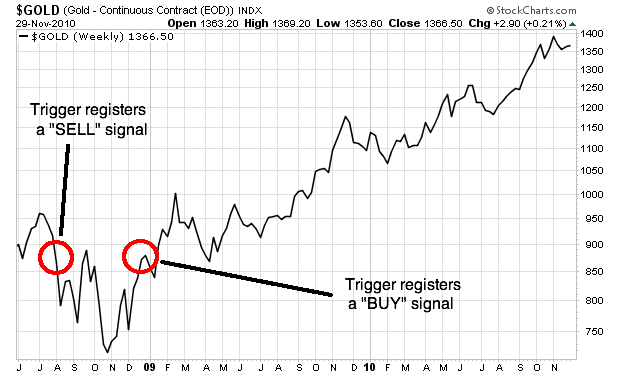

That's because this trigger registered another "Buy" signal on January 2009 when Gold was at $925.

From that point, you would have since ridden Gold's gains all the way to $1,380 per ounce where it stands today.

That's another gain of 49% so far!

So I hope you can see that this an extremely profitable trigger for determining when to buy and when to sell gold. It takes all of the guesswork out of market timing. Rather than worrying about media chatter about bubbles, you'll be perfectly positioned to catch the major rallies and avoid the devastating collapses.

So Is This Current Gold

Rally Sustainable?

... Or is it time to sell and wait out the correction? Either way, you'll know for certain with my Gold Trigger.

And now here's the deal: I'm giving this Trigger away with every trial subscription of Private Wealth Advisory today regardless of whether or not subscribers choose to stay with me.

Private Wealth Advisory is my bi-weekly paid newsletter devoted to helping investors profit from the financial markets. Delivered to your inbox every other Wednesday after the US markets close, Private Wealth Advisory presents a break-down of all the major asset classes.

Using my proprietary trading insights and the trading triggers I've developed over years as a financial analyst, I determine which assets are primed to rally and which are primed to drop. I present this analysis to you in plain, easy to understand terms with ample charts and diagrams to help you see the market "through my eyes."

Then, when it comes time to "pull the trigger" on a trade, I issue real-time alerts via email, notifying subscribers what to buy or sell and at what prices to do so.

Here's how Private Wealth Advisory will help you protect yourself:

I. The 'IF YOU HAVE TO OWN STOCKS' Portfolio

... will help investors who must remain invested in stocks for whatever reason. The investments that comprise this portfolio are the highest quality and most solid stocks available.

They all share the same qualities: low debt, lots of cash, strong results, and major competitive advantages. Not only are they cheap today (yes, even by historic standards) but they're also the most bulletproof during a crash. On average, this portfolio outperformed the S&P 500 by 10-20% during 2008's collapse.

These are the companies you want to own going forward if you have to remain invested to the long side.

II. The 'STOCKS COME UNHINGED' Portfolio

... will function as a "hedging" device against a market downturn. These are the "garbage" stocks: companies whose core businesses flat out stink. Their stories are all the same: worsening fundamentals, excessive debt, accounting "issues", and so forth.

Of the numerous companies in this list, I've picked the ones with the most ridiculously overstretched charts. The ones with the most eye-poppingly bad businesses. The ones that are just screaming "Sell me!"

Then I wait for my "sell" triggers to hit -- and we'll go short.

III. The 'COMING CRISIS' Portfolio

... is my version of "financial catastrophe insurance." It consists of investments that will rack up double -- if not triple -- digit gains during times of crisis. They're quick and easy tools to produce outsized profits when the financial world starts to crumble.

We don't own these investments yet, though. We've simply added them to our "watch list" so far.

How will we know when to buy them?

It's simple. I've identified a metric that's "triggered" before every crash in the last 25 years. It gave a clear signal before the 1987 Crash ... the 1999 Tech Bubble ... the 2007 Top .. and the 2008 Crisis too.

This metric takes the guesswork out of calling a crash. So right now, we're simply waiting for it to go off once again. When it does, we'll enter our "Crisis" trades (there's currently 5 of them) and we'll make some serious money while most investors lose their shirts.

IV. The 'BULLION' Portfolio

... gives you access to the very best precious metals investments as the world's currencies begin burning even more fiercely than they are now.

You've heard about the troubles with the Euro and the Pound. The dollar's crisis is on the way. Meanwhile gold is hitting new highs for all the reasons I've already discussed.

But you can't buy just any gold investment out there: I've applied a rigorous selection policy to home in on the very best gold investments. The companies and ETFs I've identified will outperform as the "King of Currencies" takes its throne in the weeks and months to come.

Plus I recommend the best way to buy and store bullion as the ultimate store of value once inflation really hits home.

And Who Am I, You Ask?

My name is Graham Summers. And for the last 5 years I've been helping investors like you avoid surprises ... lock in profits ... and retire securely and with as little worry as possible. I've personally researched and analyzed over 1,000 companies worldwide after beginning my career as a research analyst at one of the largest financial research firms in Baltimore, MD.

I was the youngest Senior Analyst/Researcher in the firm's history and by the time I was 27, I was writing daily missives on investing, finance, and business to an audience of more than 140,000 investors and business owners.

I've since worked as a ...

- Marketing Director

- CEO, and

- Corporate Consultant

... with an intense understanding of larger economic trends and capital flows. I've even presented business and finance ideas to audiences in Aspen, Playa Del Carmen, Dubai, Zurich, and elsewhere. What's more, my insights have been featured on ...

- MoneyTalk Radio

- Crain's New York Business

- Financial Life Radio, Reuters

- Rolling Stone Magazine and others

So why should you care?

I Predicted the Investment Banking

Collapse & the 2008 Crash

Months Before They Happened

In 2008, I warned my subscribers to get out of the long side of the market a full 3 weeks before the October-November nightmare began.

Instead we were prepared for profits with highly-targeted shorts while everyone around us saw their portfolios sliced by a third.

Then, when the market bottomed out ...

Anyone who had followed my '2008 crash' trades collected double and triple digit gains in the final months of 2008.

And of course 2010 is shaping up to be just as bad -- if not worse -- than 2008.

That might sound scary, but market chaos can be enormously profitable with the right strategy.

I made money with my short positions in 2008 (while everyone else lost 30%). And I can demonstrate that there?'s a stable and even prosperous future ahead of you if you?re willing to do 2 things:

Make money by going long or short as needed, and

Listen to honest, transparent insights you won't find anywhere else

Don't forget that my Correction Now, Coming Crisis, Bullion, and If You Must Be In Stocks portfolios are all designed to protect your money during the worst of the disasters to come.

Worrying does nothing for your financial or emotional health. And getting angry at Wall Street (or the government) might make you feel good for 15 minutes, but it doesn't put any dollars in your account.

I'll help keep your money safe until the storm passes. And here's my 5 point guarantee ...

"You'll learn more in one month

of Private Wealth Advisory than

years of academic study or

any MBA program"

I offer a full 30-day trial of my newsletter.

That's 30 days to explore Private Wealth Advisory's historic archives as well as 2 "hot off the press" issues while still having the option of cancelling and getting a full refund.

I personally guarantee that in the next 30 days as a Private Wealth Advisory subscriber, you'll ...

- Save hours of your valuable time researching key trends, investments and opportunities in the U.S. markets (I've done all the hard work for you)

- Discover how to conveniently buy and short entire sectors and asset classes using nothing more than your regular brokerage account (I explain everything in plain language)

- Dramatically enhance your investment knowledge above that of many so-called financial professionals (including the media idiots who are slaves to Wall Street advertising dollars)

- Make more informed investment decisions with more confidence than you feel right now (I provide realistic entry and exit point recommendations on all my picks), and ...

- Learn more real investment knowledge from one month of reading Private Wealth Advisory than you'll get in years of academic study or any MBA program

In the next 30 days, you must agree that I've delivered on every promise above. If not, I'll provide a full refund -- no questions asked. That's plenty of time for you to evaluate and profit from my suggestions while still qualifying for a full refund if you decide Private Wealth Advisory isn't for you.

Everything you've learned from me, including my trading ideas, market analysis, and trading triggers are yours to keep, EVEN IF YOU CHOOSE TO CANCEL.

I trust you'll be honest with me, because in a sea of sharks out to steal your hard-earned cash, I'm on your side.

I sincerely look forward to making you a more savvy and more profitable investor than you are now!

Graham Summers

Editor, Gains, Pains & Capital

So just how profitable is Private Wealth Advisory anyway?

Well... 37 out of the last 54 Private Wealth Advisory trades have been profitable. Of the losers, the largest single loss was -9%. All the others were in the low single digits.

Meanwhile, the winners have included gains of 10%, 13%, 16%, 18%, 19% and more.

To join Private Wealth Advisory subscribers in gains like those, learn my proprietary "Buy and Hold" Gold Trigger, and start turning market volatility into profitable trades...

Sincerely,

Graham Summers

Editor, Gains, Pains & Capital

Free Limited-Time Bonuses!

P.S. For a limited time, you'll also receive a free copy of the The Phoenix Investor Personal Protection Kit with your subscription to Private Wealth Advisory. This kit includes 3 reports to help you prepare for the worst effects of the financial crisis.

They explain precisely how we got to where we are today, the biggest issues plaguing our financial system, where the systemic risk lies, and how to prepare yourself for the next round of the Financial Crisis. The information inside could literally be a life-saver for you and your family.

This is a limited time offer so please act now.

P.P.S. Another bonus! I've just finished a Special Report that's exclusive for Private Wealth Advisory subscribers. It's called The Debt Spiral and it's literally worth your retirement if you're depending on bonds.

Here's how it can educate (and even enrich) you ...

- Why the structural issues plaguing the world's most critical financial markets haven't been fixed and why it's extremely unlikely they ever will be.

- Why the US's fiscal condition is as bad if not worse than Greece's. (The US media never discusses this and you'll soon understand why.)

- What a debt spiral is and why we're just entering one now with renewed acceleration.

- The 30 year bull market that's about to end in spectacular fashion and why this can cripple your retirement if you're not prepared.

- The one super-instrument that will provide you with mega-returns when this bull market fails (No, it's not gold.)

- Exactly when to buy this profit train to ensure you're not too early or too late.

Again, the Debt Spiral is available only for Private Wealth Advisory members - this expose alone could save you everything you've worked for by changing your thinking on government debt! Just click the link below and subscribe now ...